32+ reverse mortgage rates and fees

Web In the case of a Home Equity Conversion Mortgage HECM also known as a reverse mortgage there are both upfront and ongoing costs that youll need to consider before you choose to tap into your homes equity. Between the interest rate origination fees mortgage insurance appraisal fees title insurance fees and other closing costs the total could be as high as.

![]()

Reverse Mortgage Interest Rates And Fees Your Complete Guide

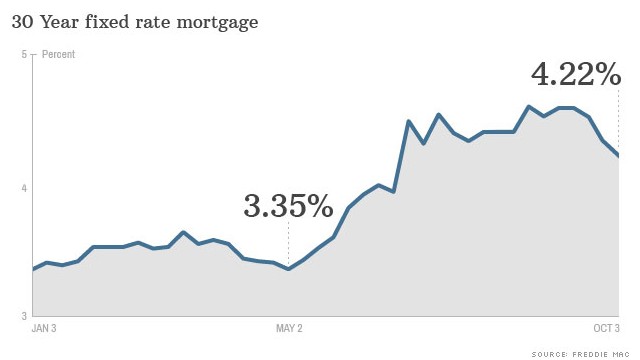

Web Compare Rates Todays Mortgage Rates 30-Year Mortgage Rates 15-Year Mortgage Rates 51 Arm Mortgage Rates 71 Arm Mortgage Rates Lender Reviews Quicken Loans Mortgage Review Rocket Mortgage Review Chase Mortgage Review.

. Some reverse mortgages mostly HECMs offer fixed rates but they tend to make you take your loan as a lump sum at. Web Reverse mortgage rates usually are higher than interest rates for other types of mortgage loans such as purchase loans or home equity loans. Web All mortgages have costs but reverse mortgages can be pricey compared to traditional mortgages.

For Homeowners Age 61. Federally backed reverse mortgages have a 2 upfront mortgage insurance premium and annual premiums of 05. And a loan servicing fee.

Get A Free Information Kit. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Currently a loan origination fee is either 2500 or 2 of the first 200000 of your propertys market.

Typically a reverse mortgage loan is more expensive than other home loans. Ad 10 Best Home Loan Lenders Compared Reviewed. Ad How Does A Reverse Mortgage Work.

For homes valued at 125000 or less the origination fee is capped at 2500. Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad Compare the Best Reverse Mortgage Lenders.

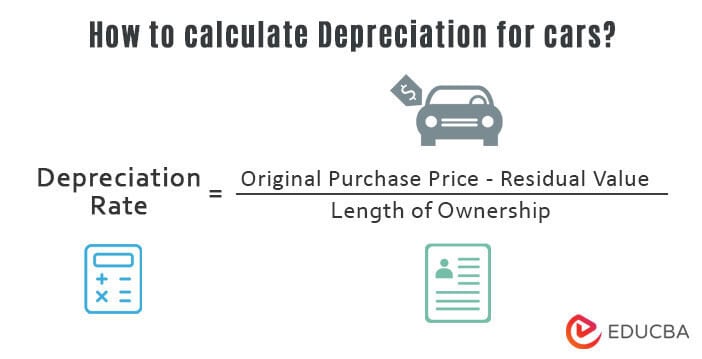

For Homeowners Age 61. Third-party fees for closing costs. Web An origination fee is used to cover a lenders operating costs when processing underwriting and closing your reverse mortgage loan.

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web Mortgage insurance premiums. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

Try Our Free Calculator To Receive a General Estimate If You Are Eligible. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. A loan origination fee capped at 6000.

Ad Compare the Best Reverse Mortgage Lenders. For Homeowners Age 61. 5 You also need to factor in additional.

Lenders may also charge up to 2500 if the home is worth. Web Fees will include mortgage insurance premiums both initial and annual. Lock Your Rate Today.

Web Fees vary from lender to lender and are capped by the FHA. Origination fees or a fee charged by a reverse mortgage lender is charged when entering a loan agreement to cover the cost of processing the loan. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

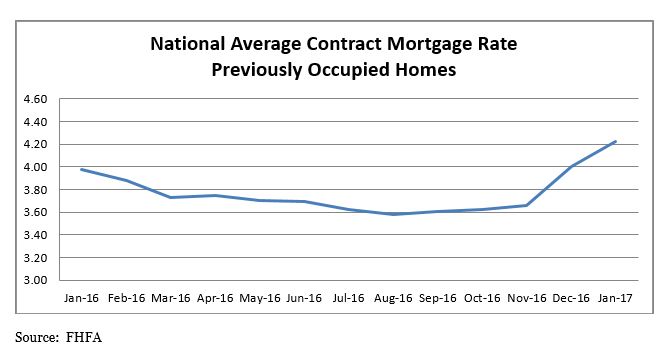

Learn More See If You Qualify. Web As an example the National Reverse Mortgage Lenders Association NRMLA reverse mortgage calculator lists an average HECM fixed rate of 5060 for the month of December 2016. Web The cost of a reverse mortgage loan will depend on the type of loan and the lender you choose.

Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for. For Homeowners Age 61.

Comparisons Trusted by 55000000. Web Reverse mortgages with variable rates tend to give you more options on how you get your money but you run the risk that the rate could go up. Official interpretation of 33 c 1 Costs to Consumer Show 2 Payments to consumer.

Get A Free Information Kit. With a reverse mortgage loan you will owe the money you borrowed as well as. For homes worth more than 125000 the lender is allowed to charge 2 on the first 200000 and 1 on the value of the home.

Web The FHA uses a formula to determine what the lender can charge. Check out some of the costs you can expect to. Get Instantly Matched With Your Ideal Mortgage Lender.

Actual rates available to borrowers will vary and are dependent on loan. 2 of the first 200000 of the propertys value and 1 of the amount over 200000 A maximum of a 6000 origination fee A lender can charge a HECM origination fee up to 2500 if your. Web The size of the reverse mortgage you get is determined by a formula that considers your age the homes value and interest rates lately reverse mortgage rates are hovering around 325 to 7 for.

Web According to this formula lenders can charge 2 of the first 200000 of the market value of the home and 1 of the remaining amount if the home is worth more than 200000. Web All costs and charges to the consumer including the costs of any annuity the consumer purchases as part of the reverse mortgage transaction. Mortgage insurance is meant to protect lenders in case of.

Ask Us Your Reverse Mortgage Questions to Decide if its the Right Option for You. Origination fees are strictly regulated by HUD and insured by the FHA.

Reverse Mortgage Interest Rates 2021 Fixed Variable Goodlife

Current Reverse Mortgage Rates Today S Rates Apr Arlo

What Is The Interest Rate On A Reverse Mortgage

Public Affairs Detail Federal Housing Finance Agency

![]()

Reverse Mortgage Interest Rates And Fees Your Complete Guide

![]()

What Are The Fees To Get A Reverse Mortgage Nerdwallet

This Week S Top 5 Zero Carbon Interest Co Nz

Depreciation For Cars Meaning Rates Formula Examples

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

20 Year Mortgage What Is A 20 Year Fixed Zillow

Home Mortgage Rates Drop Again

Mortgage Rates Slide The Fastest In Four Years But It May Be Too Late For The Housing Market Marketwatch

Economist S View Survey Of Long Term Interest Rates

Current Reverse Mortgage Rates Today S Rates Apr Arlo

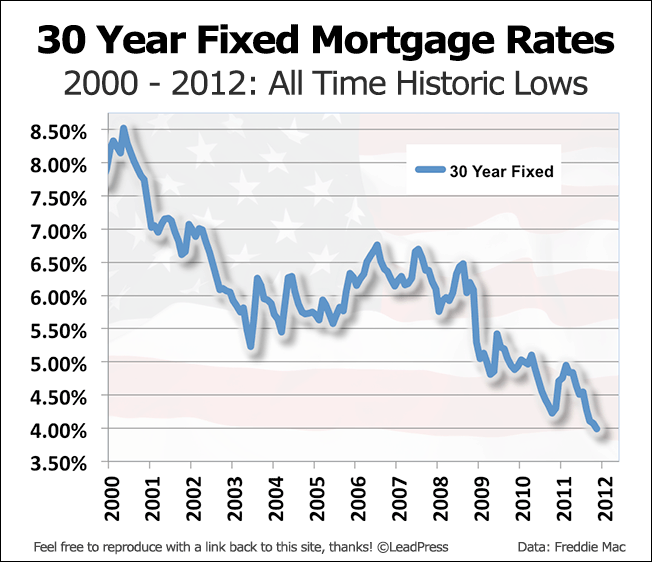

A History Of 30 Year Fixed Mortgage Rates Intercounty Mortgage Network Corp

Compare Reverse Mortgage Rates Costs And Fees In 2021

Current Reverse Mortgage Rates Today S Rates Apr Arlo